As 2003 continues, the threat of war in the Middle East and the slow economy remain major concerns. Still, key pigment makers are cautiously optimistic that the future offers some promise, as innovative products and services and state-of-the-art manufacturing plants may lead to better times ahead.

|

|

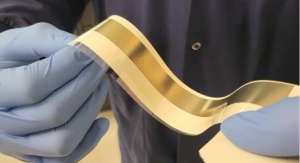

| Photo courtesy of Ciba Specialty Chemicals |

Looking Back at 2002

For the most part, 2002 was flat for pigment sales as demand for print remained slow.

“2002 started slowly because of the continuing advertising slump in the aftermath of 9/11,” said Tom Ashe, vice president of marketing and sales at CDR Pigments and Dispersions. “However, advertising started a comeback in the second half, and the year finished with an upward trend.”

“The industry reportedly saw sales lower than expectations with demand for print flat,” said Ed daPonte, process pigments business manager for BASF Corporation.

“The ink industry saw another slow year in 2002 and this was reflected in all raw material purchases,” said David Dugan, sales/key accounts manager at Clariant Corporation. “In addition, new sources of organic pigments have come to the U.S. from overseas with very low prices trying to buy their way into the market. Traditional sources such as Clariant have met the prices being offered. Only recently have we seen the trend slow as raw material prices have risen on a global scale.”

“Overall we had a good year in difficult circumstances. We had good sales growth in Asia, and in particular in China,” said Christopher Bridge, regional marketing manager – Americas, imaging & inks business line, coating effects segment for Ciba Specialty Chemicals.

“We were flat for 2002. However, we did have a nice pick up towards the end of the year which has carried through January 2003,” said Andy Grabacki, vice president of sales for General Press Colors Ltd.

“Max Marx had a reasonably satisfactory year in 2002,” said Mike Guzzo, vice president of Max Marx Color.

Sun Chemical combined alliances and new products to make gains during 2002.

“2002 was an exciting year for Sun’s pigment business in general and very rewarding with respect to the ink industry in North America,” said Edwin B. Faulkner, director – communications and regulatory affairs for Sun Chemical’s Colors Group. “In a declining ink market, our pigment business grew both in volume and market share.

“We were able to accomplish this growth in two ways,” Mr. Faulkner said. “First, we built on the alliances that have been established over the years with key customers. These alliances allow the customer to obtain a total value in use with our products. Second, we continued to develop and market new products that satisfy the ever-increasing demands for performance in the ink industry.”

As for 2003, no one really knows what to expect, as the political situation worldwide remains unstable.

“January 2003 was a good month but concerns about the tough economic conditions, the threat of war and weakness in the job market make an uncertain environment for the months ahead,” Mr. Ashe said.

“We expect 2003 to be full of surprises and are optimistic in a very weak economy with the threat of war pending,” Mr. Guzzo said.

“The expectations for 2003 are cautiously optimistic with growth expected to be around 2 percent to 3 percent,” said Mr. daPonte. “With the softening dollar, it is expected that imported raw materials will hold if not slightly increase.”

“For 2003 we do not expect substantial changes in the difficult trading conditions,” Mr. Bridge said. “Our forecasts assume an economic recovery later in the year in the U.S., followed by Europe.”

“We have been hearing that 2003 should be a better year than 2002. It’s a cautious optimism,” Mr. Grabacki said. “We should get a better indication of how things are going to be as we get into March and April. As the economy goes, so do we.”

The pigment industry faces similar challenges in Canada.

“DCC has found the industry to be soft from previous years and the Canadian ink market is shrinking with Flint shifting production out of Canada and back to the U.S. Expectations for 2003 are for modest growth over 2002,” said Steve Whate, coatings industry coordinator at Dominion Colour Corporation.

The prolonged economic downturn also impacted the metallic side.

“Silberline had anticipated a stronger 2002 than was realized,” said Pete Stone, market development manager at Silberline Manufacturing Co., Inc. “We feel this was due mostly to an erratic and generally poor performing economy, particularly during the second half of the year.”

“Overall we’re satisfied with our 2002 result although we would’ve enjoyed a higher level of sustained, consistent activity,” said Ron Oberstar, Eckart America’s director of sales – graphic arts. “Considering the flat to down year experienced by our ink making partners and understanding how difficult it has been for them to maintain a consistent level of business, Eckart, as a supplier, necessarily follows in their wake. Try as we might to create, support and grow the overall metallic market, the print customer had only so many ad and design dollars dedicated to print and packaging.”

Both Mr. Stone and Mr. Oberstar believe that this year should be a better one for sales.

“We are looking for a much stronger 2003 based on anticipations of a modest economic recovery and successful product introductions across our line of metallic pigments for inks,” Mr. Stone said.

|

|

| Photo courtesy of Ciba Specialty Chemicals |

“Looking ahead to 2003, we’re cautiously optimistic that we will continue to see modest growth in the 3 percent to 5 percent range,” Mr. Oberstar said.

“2002 was a challenging year for the industry,” said Elise Balsamo, marketing manager, MD-Both Industries. “In a poor economy, people look to reduce costs and this has translated to a drop in demand for metallics. Both of MD-Both's parent companies in Europe have been working hard to increase manufacturing efficiencies. But considering the state of the economy and the associated demand for metallics, we were still relatively pleased.”

Pricing Concerns

The price of pigments for inks has remained, for the most part, relatively stable during recent years. However, there are some segments where the cost of raw materials for pigments are on the rise.

“Prices have been more stable globally in 2002 than for several years,” Mr. Bridge said. “There are of course regional variations, and in North America we have seen more price pressure than in other regions. In some cases this has been because of higher prices than the global average previously, which has led to it being seen as more attractive than other markets, particularly to Asian sources. Towards the end of the year there were some necessary upward price movements made in diarylide yellows and lithol rubine, which are currently holding.”

In particular, the price of naphthalene has risen as its production in China has declined.

“Napthalene prices have continued to be affected, specifically in lithol rubine,” said Joe Bauer, director, performance chemicals for printing industry, BASF. “There’s definitely been some upward movement there, and there have also been some major raw materials price increases domestically as well for us and our competitors.”

“Napthalene prices have been rising as a result of the steel tariffs imposed by President Bush,” Mr. Faulkner said. “Napthalene is a byproduct of steel production and as steel production has lessened in China due to the tariff, napthalene has become more scarce.”

Industry leaders are watching other raw materials closely. In particular, prices for pthalic anhydrides have been rising, and yellow feedstocks and intermediates are of interest.

“The most recent trends we have seen are key intermediate price hikes causing a number organic pigment producers to increase their prices in January,” Mr. Guzzo said. “At the same time, imported pigments from China and India are either dropping or remaining stable. This puts a big strain on the domestic producer who is trying to maintain sales and keep profits proportionate with last year’s results.”

All of this pressure from raw material suppliers is occurring simultaneously with ink manufacturers looking for better prices and more value. The end result is that pigment manufacturers are watching their margins being squeezed.

“Ink makers are continuing to put downward pressure on pigment prices based on cheaper overseas prices,” Mr. Whate said. “However naphthalene shortages are dramatically effecting pigment raw material prices and forcing pigment prices to rise on naphthalene-based pigments.”

“Our customers are continuing to look for the best possible pricing while demanding continued high quality and service,” said Mr. Stone. “Providing a value-added product is always the preferred note to maintaining acceptable pricing.”

Pigment companies have absorbed price increases in recent years, but that comes at a cost, both in terms of value for shareholders and for developing new capabilities.

“We’re beginning to see early indications of raw material price increases from our suppliers,” Mr. Oberstar said. “A prudent assessment of these increased costs and how they are communicated through to our customers is a challenge. Ongoing absorption is not a healthy long-term strategy.”

“Pressure to lower prices is constant, but perhaps not as strong in the recent past,” Mr. Dugan said. “Raw material increases, as well as energy cost increases are affecting all of us and something will need to be done regarding pricing soon.”

“The biggest issues that all North American pigment producers face are how to obtain an acceptable return on investment for our shareholders and the looming increase in raw material prices,” Mr. Faulkner said. “With the potential shortage of some basic building block chemicals and the uncertainty of oil prices, raw material increases have been seen and are more expected in 2003. These factors certainly speak to the fact that pigment prices are likely to stabilize and then increase as 2003 unfolds. The pigment business has grown to be a truly global one requiring Sun and the other world class players to operate in all parts of the world to be successful.”

Trends for the Ink Industry

As 2003 begins, price pressures remain the most serious concern for pigment manufacturers, who have to find ways to contain costs.

“I see closer quality control and lower prices dominating the industry this year,” Mr. Dugan said. “Quality initiatives taken by printers and ink manufacturers will put pressure on suppliers of raw materials to meet this trend.”

“There is continuous, unrelenting pressure to reduce cost,” said Rick Campbell, vice president, sales and marketing for Lansco Colors. “There was weak growth for the industry, somewhat better for Lansco Colors. The ink industry seems to continue to demand lower cost from their suppliers and Lansco is working to meet this need with the broadest line of pigments from non-traditional sources.”

“Trends for the ink industry continue to shift toward raw materials from the Asian market, and more of the classical producers are looking to the Asian market to produce material,” Mr. daPonte said.

“One trend is centralized manufacturing with mother plants doing the bulk of manufacturing and supplying the branches,” said Mr. Grabacki. “Also, quality of flushes seems to be taking a back seat to pricing. Customers want to see pricing before anything else.”

Improving efficiency is critical for companies.

“It’s no secret that an increasing percentage of the pigments sold in North America are now made in Asia,” Mr. Faulkner said. “These lower-priced pigments, while not up to the quality levels of those produced in the States, have put pressure on margin levels for the U.S. manufacturers. We have actually looked at this issue in a positive way, using it as a springboard to improve the efficiency of our operations and as a catalyst to lower our manufacturing costs.”

Quality, consistency and cost containment remain critical for pigment companies.

“While quality and consistency have always been factors, the demand for both – especially consistency – has reached new highs,” Mr. Ashe said.

“We see a keener focus on cost containment,” Mr. Oberstar said. “Areas such as inventories, reliance on suppliers for superior service and product quality with zero defects are considered a given. Eckart is well positioned to exceed all of these expectations.”

Analyzing new raw materials that help create improved products while reducing costs in essential for pigment manufacturers.

“The most difficult challenges remain to keep product integrity at a premium and to maintain a competitive edge by keeping variable costs down like raw materials,” Mr. Guzzo said.

“We are constantly evaluating new pigments, resins, surfactants, etc. in an ongoing effort to improve our products and develop new ones to meet our customers’ needs,” said Joe Alex, president of Alex Color.

Moving into more specialty areas that provide better margins is one approach that pigment manufacturers are taking.

“There is a high focus on moving away from business that is seen as of low profitability, with over-capacity, and customer consolidation, and into areas which are seen to be offering higher margins, for example UV inks, solvent packaging inks and various specialty applications,” Mr. Bridge said. “This is in some cases defensive, for example in screen inks and also the photographic industry moving into ink jet, where they see the current business will either shrink or no longer exist.”

UV is also of interest on the metallic side, which also sees challenges due to increasing capacity.

“We are seeing a growing interest in metallic pigments for use in UV curable ink systems and a continuing demand for small particle size pigments with exceptional brilliance,” Mr. Stone said.

“Some of the biggest challenges for the metallic market will be growing sales, maintaining a level of profitability in an industry with increasing capacity,” Mr. Oberstar said. “Long-range changes in the supplier matrix through new entrants and realignments is also intriguing.”

Keys for the Future

With all of the challenges that are occurring in the pigment industry, what is most needed to survive and succeed in the future? Most importantly, the ability to create new products is essential.

“We see that innovation is the key – to innovate faster than the copiers can copy,” Mr. Bridge said. “ As well as the extensive list of pigment releases during the year, we also have a broad portfolio of additives and resins which are offered to the ink industry, and which will be further broadened during the coming year. Operational excellence is the key in our continuing operations, and to help our customers as they seek to move into more profitable areas.”

“We continue to offer specialized pigments to a number of expanding markets and maintain an efficient operation that responds to today’s ink industry.” Mr. Guzzo said.

“We are becoming more aggressive in our purchasing and selling,” Mr. Grabacki said. “We are looking into some new products that are outside the realm of conventional offset flushes. This should broaden our base.”

“We are always looking at a new sources and new products,” Mr. Campbell said. “We continually strive to make sure our customers buy cost effectively with outstanding service.”

New facilities can be the key to ensuring better quality and consistency, two attributes sought by ink manufacturers.

“Clariant continues to invest in our local plants, as well as globally, to ensure that not only are our customers getting the best quality, but the best value from Clariant,” Mr. Dugan said. “In addition, our recent strategic reorganization of the Pigments and Additives Division along customer segment lines will improve our response and service to our customers within the various industries we serve.”

“BASF has continued to invest in its sites as well as improving the efficiency of its manufacturing process,” Mr. daPonte said. “BASF is well equipped to be competitive in the challenging market while maintaining its offerings of world-class products.”

“CDR continues to find ways to upgrade quality while taking cost out through automation and increased productivity,” Mr. Ashe said. “We invest in improving our people as well as our plants and this always makes a company better.”

New products and state-of-the-art manufacturing facilities are also a recipe for success for metallic companies.

“Silberline is focusing on providing products to the ink industry that provide the most flexibility to the ink formulator while providing the best value and highest technology possible,” Mr. Stone said. “We feel this approach will allow us to meet any challenges that might arise whether anticipated or not.”

“Eckart has been the key supplier for metallics and special effect pigments for more than 125 years and we continually evaluate and anticipate changes on the metallic horizon and act accordingly,” Mr. Oberstar said. “We’re re-engineering our domestic facilities, enabling Eckart to exceed our customers’ expectations while providing a one-stop domestic source of high quality, consistent bronze and aluminum technologies. We’re dedicated to advancing the consumers’ expectations while delivering eye catching packaging and printing.”

Even with innovation, expansion and strong customer service, the best hope for the pigment industry would be an improved economy for printers, and Mr. Faulkner is optimistic that will ultimately be the case.

“2003 will provide a number of challenges for the North American pigment producers,” Mr. Faulkner said. “All the signs point to an improvement in the print area, which, of course means higher pigment demand. We, at Sun, expect the year to be very good for us. We are poised with all the necessary resources in place to meet the requirements of the printing ink industry.”

|