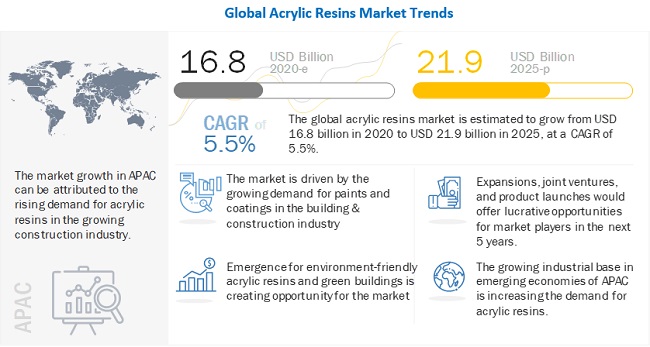

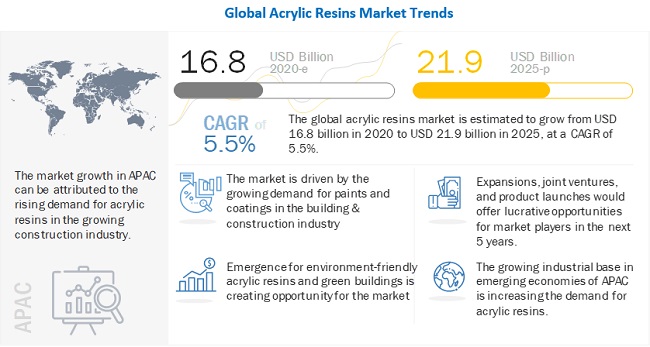

The global acrylic resins market size is projected to reach $21.9 billion by 2025 from $16.8 billion in 2020, at a CAGR of 5.5% during the forecast period.

The growing demand for acrylic resins is due to the growing construction industry in emerging as well as developed economies.

Also, the increasing industrial base in countries such as China, India, South Korea, Australia, Brazil, Chile, and others is driving the market growth.

The acrylic resins are used mainly in the construction industry and industrial sectors. COVID-19 has severely impacted this industry.

-

The lockdown in various countries and logistical restrictions have adversely impacted the construction industry. Supply chain disruptions, workforce unavailability, logistical restrictions, limited availability of components, demand drop, low company liquidity, and shutdown of manufacturing due to lockdown in various countries have adversely affected the industry. Raw material suppliers and other related businesses are forced to re-evaluate their strategies to cater to this industry during this crisis period;

-

Residential and commercial construction has come to a grinding halt owing to the pandemic. Acrylic resins demand from this sector is expected to be low to the medium during this crisis period. Some major issues would be a delay in order shipments, supply chain restriction, manpower & equipment shortage, and material shortage. Post conclusion of this crisis, the market is expected to revive, and demand is likely to increase for the acrylic resins market;

-

The demand for construction activities has increased in the healthcare sector, owing to the pandemic. A rise in demand for new hospitals, care institutions, pharmaceutical & medical installations has provided some stability to the construction sector thus driving the acrylic resins market. Demand for automotive is also increasing due to economic recovery and awareness surrounding individual use of transport as compared to public transportation.

Rapid industrialization and urbanization in key countries, such as China and India, have spurred the demand for acrylic resins in the past few years. The building & construction industry requires high-performance materials for protection and decorative purposes. The quality and performance of acrylic resin-based systems such as paint, coatings, adhesives and sealants for building and construction purposes must be extremely consistent, and cost-effective. As a result, the demand for acrylic resin-based systems is increasing in the building & construction industry. The increasing population in emerging regions, especially in APAC and the need for improved infrastructure and residential spaces, is expected to drive the global consumption of acrylic resins. The global population was estimated to be around 7.7 billion in 2019, with APAC having approximately 60% of the total population. Residential and commercial construction is the major contributor to the market size for acrylic resin-based systems. Residential construction grew significantly in the past few years owing to factors such as increasing disposable incomes, changing lifestyle, growing demand for single-family homes, ease of financing, and increased investments.

The harmful effects of solvent-based systems on human and environmental health are one of the major restraining factors for the market. The acute health hazards of solvent-based systems include headache, dizziness, and light‐headedness progressing to unconsciousness, and seizures. Irritation of the nose, eye and throat are also some of the other effects of working with these systems. VOCs present in paint systems are harmful to the environment as well as humans. Paints release VOCs during the drying or curing phase. VOC exposure has a degrading effect on the body with effects ranging from headaches to allergies and asthmatic reactions. Also, these can cause stress on vital body organs such as the heart and lungs.

The development of bio-based resin systems is crucial for sustaining the market in the coming years. Environment sustainability is the main goal of developing green or bio-based paints and coating systems. Environment sustainability encompasses every stage of the coating’s life cycle i.e. from raw material to resin manufacturing and formulation level. Fossil-based raw materials or feedstocks such as oil, coal and natural gas are used in most coatings raw materials. Abuse of these resources extracts a huge toll on the environment owing to the release of greenhouse gases. Raw materials based on plant biomass exhibit beneficial properties when compared to their conventional counterparts. Plant-based materials such as linseed and soya oils are still used in coating formulations but reduced amounts.

Regulatory policies and restrictions regarding the use of paints and coatings differ from country to country. Variation in coating regulations mandates manufacturers to update and evolve their processes to comply with new policies. Products that fail the requirements are not allowed for sale in respective markets. Acrylic resins are used in different industries as per requirement and for controlling the emissions from specific formulations. Various regulations regarding paints & coatings such as DIN EN 16516, EU Construction Products Regulation (CPR), REACH – Registration, Evaluation, Authorization and Restriction of Chemicals, US EPA, and similar others regulate the production and sale in Europe and the US. Currently, the regulations are based on the concentration of VOCs in exhaust gases, while as per industry strategy, regulations framed around air quality standards or emission limit values expressed as the mass of total emissions would be desirable in the long run.

Hybrid acrylic resins are generally a mixture of two functional monomers. These resins were created to combine the desirable properties of both resins to achieve required functioning while offsetting their shortcomings. These are mainly used in coating applications due to their higher performance properties such as ultraviolet (UV) resistance, gloss retention and improved adhesion.

Water-based acrylic resins are effective as their solvent-based but also have a low environmental impact. These resins are used increasingly in the current period owing to their sustainable nature and easy formulation processes, their excellent durability, quick-drying times and emission of low odor. Using solvent-based acrylic resins in confined spaces can be unpleasant or hazardous to the workers due to the evaporation of solvents, this drives the use of water-based resins.

Acrylics are utilized in a broad range of applications in paints & coatings industry, right from architectural coatings to industrial coatings. Acrylic resins show good chemical, photochemical resistance, good colors and gloss retention properties are easy to handle, cost-efficient, and exhibit superior performance in a wide variety of applications such as roof coating, wall coating, interior and exterior paints, and others.

Acrylic resins are used in manufacturing coatings, paints, adhesives, sealants, and other products which are mandatorily used in the construction sector. The growing number of residential and commercial construction in emerging economies and restoration of existing buildings in developed economies are driving consumption of acrylic resins in the building & construction industry. Acrylic resins have excellent adhesion, flexibility and elongation, UV stability, carbonation resistance, and are environment friendly which are the major adoption factors for these resins in the sector.

The acrylic resins market in APAC is projected to register the highest CAGR during the forecast period. The demand in APAC is driven by the growing construction industry, increased consumer spending, and strong economic growth.

The recent COVID-19 pandemic is expected to impact the global construction industry as well as the industrial sectors. COVID-19 led the construction and industrial sectors into an unknown operating environment, globally. Government restrictions on the number of people that can gather at one particular place, severely impacted the industries. E.g., in the US, automotive sales dropped over 25% y-o-y in June 2020. Logistical constraints, manpower shortages, low demand, and government restrictions had forced temporary shutdowns, hence, disrupting industrial activities in the US. Similarly, economies such as China, India, and others are also facing the brunt of the COVID-19 pandemic.