David Savastano, Editor01.10.19

The past few years have been tumultuous for the purchasing departments of ink manufacturers. Key raw materials like titanium dioxide (in 2017), major photoinitiators (in 2018) and pigments and intermediates have become scarce due to plant closures, fires and regulatory enforcement. Demand for the materials that are available rose dramatically, leading to higher costs. Add to that higher transportation costs, tariffs and more, and it is a challenge for ink companies to keep their prices level.

The ink industry is typically reluctant to raise its prices, as printers are also under price constraints throughout their supply chains as well as pressure from brand owners, etc. to hold prices down. Still, ink companies can’t afford to take losses on their products.

The past year has seen many announcements of price increases (it should be noted that not every company makes announcements). In the fourth quarter of 2018 alone, Sun Chemical, Flint Group and Siegwerk announced their needs for higher prices.

Siegwerk increased ink prices on all of its inks and coatings in the US and Canada, citing supply disruptions, tariffs, environmental policies and higher costs for transportation.

“With no sign of relief moving into 2019, Siegwerk will implement price increases and/or surcharges across its entire product portfolio within the US and Canada,” said Dave Hiserodt, president CUSA in announcing the increases. “The impact of the combined overall drivers is unprecedented and Siegwerk must act in order to ensure continued supply of its quality, safe ink solutions.”

Flint Group Packaging Inks also announced their own price increases on its product lines throughout the US and Canada, noting that higher raw material and transportation costs left no alternative.

“As stated in December 2017, we continue to deploy significant capital to efficiency projects in order to mitigate as many headwinds as possible; however, the combined impact of the tariffs, raw material and freight inflation has become untenable,” Doug Aldred, president Packaging Inks & Resins, announced.

The story is similar in Europe. Sun Chemical raised its liquid ink prices, noting higher costs for solvents, acrylic derivatives, organic pigments, and polyols and isocyanates, among other ingredients.

“The increasing raw material costs continue at an unprecedented rate and require us to increase customer prices,” said Felipe Mellado, chief marketing officer, Sun Chemical, in making the announcement. “We will continue to work with our supply chain partners to manage and minimize the impact on our customers.”

Flint Group also raised its prices in Europe, noting higher prices in pigments, solvents, resins, and freight.

“Raw material and freight inflation have become untenable, hence, we are forced to look toward the market to alleviate some of the cost burdens we face,” noted Doug Aldred, president of Packaging Inks and Resins. In addition, Flint Group raised prices for its inks in India.

Siegwerk also announced its price increase for all packaging inks and varnishes in EMEA. The company noted higher costs for photoinitiators, UV monomers, pigments, acrylic resins and other ingredients. The increases will go into effect on Feb. 1, 2019

“In order to ensure that customers benefit from continued high levels of quality, service and consistency, Siegwerk now needs to pass on these higher costs,” said Dr. Jan Breitkopf, president packaging EMEA, in announcing its price increases.

Raising prices on inks is usually a last resort. Companies will typically look at ways to replace scarce or increasingly expensive raw materials in formulations, but that takes time and requires getting approvals. For ink manufacturers, increasing prices is a necessity as they face higher costs from their own suppliers.

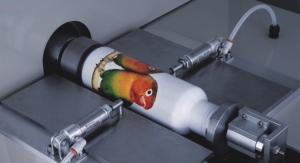

Source: Siegwerk

The ink industry is typically reluctant to raise its prices, as printers are also under price constraints throughout their supply chains as well as pressure from brand owners, etc. to hold prices down. Still, ink companies can’t afford to take losses on their products.

The past year has seen many announcements of price increases (it should be noted that not every company makes announcements). In the fourth quarter of 2018 alone, Sun Chemical, Flint Group and Siegwerk announced their needs for higher prices.

Siegwerk increased ink prices on all of its inks and coatings in the US and Canada, citing supply disruptions, tariffs, environmental policies and higher costs for transportation.

“With no sign of relief moving into 2019, Siegwerk will implement price increases and/or surcharges across its entire product portfolio within the US and Canada,” said Dave Hiserodt, president CUSA in announcing the increases. “The impact of the combined overall drivers is unprecedented and Siegwerk must act in order to ensure continued supply of its quality, safe ink solutions.”

Flint Group Packaging Inks also announced their own price increases on its product lines throughout the US and Canada, noting that higher raw material and transportation costs left no alternative.

“As stated in December 2017, we continue to deploy significant capital to efficiency projects in order to mitigate as many headwinds as possible; however, the combined impact of the tariffs, raw material and freight inflation has become untenable,” Doug Aldred, president Packaging Inks & Resins, announced.

The story is similar in Europe. Sun Chemical raised its liquid ink prices, noting higher costs for solvents, acrylic derivatives, organic pigments, and polyols and isocyanates, among other ingredients.

“The increasing raw material costs continue at an unprecedented rate and require us to increase customer prices,” said Felipe Mellado, chief marketing officer, Sun Chemical, in making the announcement. “We will continue to work with our supply chain partners to manage and minimize the impact on our customers.”

Flint Group also raised its prices in Europe, noting higher prices in pigments, solvents, resins, and freight.

“Raw material and freight inflation have become untenable, hence, we are forced to look toward the market to alleviate some of the cost burdens we face,” noted Doug Aldred, president of Packaging Inks and Resins. In addition, Flint Group raised prices for its inks in India.

Siegwerk also announced its price increase for all packaging inks and varnishes in EMEA. The company noted higher costs for photoinitiators, UV monomers, pigments, acrylic resins and other ingredients. The increases will go into effect on Feb. 1, 2019

“In order to ensure that customers benefit from continued high levels of quality, service and consistency, Siegwerk now needs to pass on these higher costs,” said Dr. Jan Breitkopf, president packaging EMEA, in announcing its price increases.

Raising prices on inks is usually a last resort. Companies will typically look at ways to replace scarce or increasingly expensive raw materials in formulations, but that takes time and requires getting approvals. For ink manufacturers, increasing prices is a necessity as they face higher costs from their own suppliers.

Source: Siegwerk