12.01.17

When growth areas for printing are discussed, usually it is the BRIC countries (Brazil, Russia, India and China) that are the focus. However, the Middle East, most notably Turkey, has an interesting story to tell as well.

According to Smithers Pira’s report, “The Future of Printing in MENA to 2022,” the analyst report that the Middle East and North Africa (MENA) region

According to Smithers Pira, the printing market on MENA was more than $35.1 billion in 2017. Smithers Pira anticipates 9.0% CAGR, and estimates the market at $54.0 billion in 2022.

That is a fast-growing market, and not surprisingly, ink industry leaders have taken notice. In the last six months, the following moves have been made in Turkey alone:

• Sun Chemical opened a new $30 million production facility designed for solvent-based flexible packaging in Aliağa, Turkey.

• Flint Group opened a new manufacturing facility for a full portfolio of inks in Istanbul, Turkey.

• Toyo Ink is planning a $26.7 million expansion for manufacturing inks and polymers in Manisa, Turkey.

And also in the Middle East, Sun Chemical finalized the formation of Sun Chemical Saudi Arabia LTD,its JV with Alliance Holding Company LTD, the parent company of Ink Products Company, Ltd. The JV will produce a full range of packaging and publication inks.

These are all significant investments in the region.

Sun Chemical’s new 50,000 square meter site will focus on meeting increasing demand for flexible packaging inks. Previously, the company produced both water- and solvent-based inks at its plant in Çiğli; Sun Chemical will now focus solely on water-based products there.

“The new facility in Aliağa will be a hub for our solvent-based inks serving customers directly as well as other Sun Chemical sites in Turkey, the surrounding territories and the Middle East,” said Arinç Aktan, Sun Chemical Turkey’s GM.

Krzysztof Struszczak, Flint Group’s operations director Packaging Inks for Eastern Europe, said that Flint Group’s new 3,800 square meter production facility in Istanbul was originally designed for the company’s water-based inks, but the company’s growth in other ink markets led to new plans.

“The acquisition of this new facility was initially, and strategically, planned for Flint Group’s water-based Paper & Board business segment,” Struszczak reported. “However, it soon became clear that we should combine with other key segments supplying all needs of the packaging market from this one location. Today, Flint Group’s Narrow Web, Sheetfed, and Digital Solutions (Xeikon) businesses have joined Paper & Board in this single facility.”

Toyo Printing Inks purchased 62,000 square meters of land to build its new plant, which will also manufacture polymers for inks, coatings and adhesives. Al, told, the polymer plant should be up and running by the end of 2019, with further expansions planned for ink and coating production.

“Toyo Printing Inks has simply outgrown its current space,” said Katsumi Kitagawa, CEO of the Toyo Ink Group, said of the move. “We’ve reached the point where we need to invest in advanced manufacturing technology that will allow us to better serve our customers with greater flexibility and product mix capability.”

The continued growth in the MENA printing market brings plenty of opportunities to the ink industry, and it is interesting to see ink manufacturers make moves to capitalize on this growth.

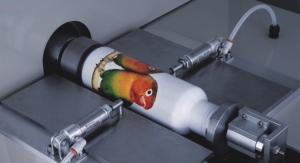

Flint Group’s new manufacturing facility in Istanbul, Turkey. (Source: Flint Group)

According to Smithers Pira’s report, “The Future of Printing in MENA to 2022,” the analyst report that the Middle East and North Africa (MENA) region

According to Smithers Pira, the printing market on MENA was more than $35.1 billion in 2017. Smithers Pira anticipates 9.0% CAGR, and estimates the market at $54.0 billion in 2022.

That is a fast-growing market, and not surprisingly, ink industry leaders have taken notice. In the last six months, the following moves have been made in Turkey alone:

• Sun Chemical opened a new $30 million production facility designed for solvent-based flexible packaging in Aliağa, Turkey.

• Flint Group opened a new manufacturing facility for a full portfolio of inks in Istanbul, Turkey.

• Toyo Ink is planning a $26.7 million expansion for manufacturing inks and polymers in Manisa, Turkey.

And also in the Middle East, Sun Chemical finalized the formation of Sun Chemical Saudi Arabia LTD,its JV with Alliance Holding Company LTD, the parent company of Ink Products Company, Ltd. The JV will produce a full range of packaging and publication inks.

These are all significant investments in the region.

Sun Chemical’s new 50,000 square meter site will focus on meeting increasing demand for flexible packaging inks. Previously, the company produced both water- and solvent-based inks at its plant in Çiğli; Sun Chemical will now focus solely on water-based products there.

“The new facility in Aliağa will be a hub for our solvent-based inks serving customers directly as well as other Sun Chemical sites in Turkey, the surrounding territories and the Middle East,” said Arinç Aktan, Sun Chemical Turkey’s GM.

Krzysztof Struszczak, Flint Group’s operations director Packaging Inks for Eastern Europe, said that Flint Group’s new 3,800 square meter production facility in Istanbul was originally designed for the company’s water-based inks, but the company’s growth in other ink markets led to new plans.

“The acquisition of this new facility was initially, and strategically, planned for Flint Group’s water-based Paper & Board business segment,” Struszczak reported. “However, it soon became clear that we should combine with other key segments supplying all needs of the packaging market from this one location. Today, Flint Group’s Narrow Web, Sheetfed, and Digital Solutions (Xeikon) businesses have joined Paper & Board in this single facility.”

Toyo Printing Inks purchased 62,000 square meters of land to build its new plant, which will also manufacture polymers for inks, coatings and adhesives. Al, told, the polymer plant should be up and running by the end of 2019, with further expansions planned for ink and coating production.

“Toyo Printing Inks has simply outgrown its current space,” said Katsumi Kitagawa, CEO of the Toyo Ink Group, said of the move. “We’ve reached the point where we need to invest in advanced manufacturing technology that will allow us to better serve our customers with greater flexibility and product mix capability.”

The continued growth in the MENA printing market brings plenty of opportunities to the ink industry, and it is interesting to see ink manufacturers make moves to capitalize on this growth.

Flint Group’s new manufacturing facility in Istanbul, Turkey. (Source: Flint Group)