The UV Ink Market Continues to Thrive

By David Savastano, Editor | 03.24.22

Ink manufacturers anticipate further expansion, with UV LED the fastest-growing segment.

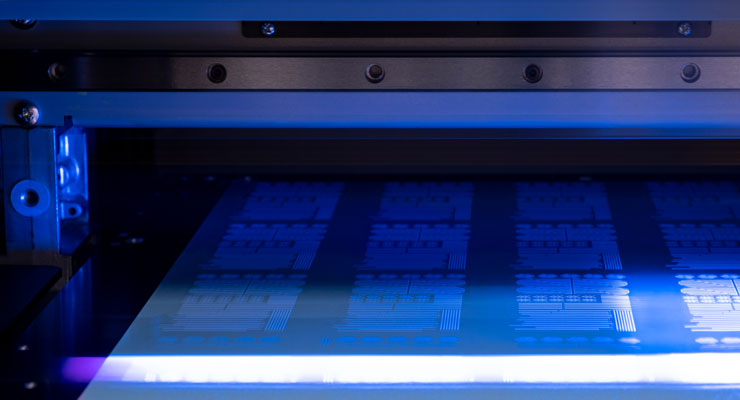

The use of energy-curable technologies (UV, UV LED and EB) has successfully grown in the graphic arts and other end use applications throughout the last decade. There are a variety of reasons for this growth –instant curing and environmental benefits being among two of the most frequently cited – and market analysts see further growth ahead.

In its report, “UV Cure Printing Inks Market Size and Forecast,” Verified Market Research puts the global UV curable ink market at US$1.83 billion in 2019, projected to reach US$3.57 billion by 2027, growing at a CAGR of 8.77 % from 2020 to 2027. Mordor Intelligence placed the market for UV cured printing inks at US$1.3 billion in 2021, with a CAGR of more than 4.5% through 2027 in its study, “UV Cured Printing Inks Market.”

Leading ink manufacturers confirm this growth. T&K Toka specializes in UV ink, and Akihiro Takamizawa, GM for its Overseas Ink Sales Division, sees further opportunities ahead, particularly for UV LED.

“In graphic arts, the growth has been driven by the switch from oil-based inks to UV inks in terms of quick-drying properties for improved work efficiency and compatibility with a wide range of substrates,” Takamizawa said. “In the future, technological growth is expected in the UV-LED field from the perspective of reducing energy consumption.”

Fabian Köhn, global head of narrow web product management for Siegwerk, said that energy curing remains a strong growth application within the graphic arts industry, further driving UV/EB ink market growth on a global basis, especially in narrow web and sheetfed printing for labels and packaging.

“The decline in 2020, due to the pandemic situation and related uncertainties, has been made up for in 2021,” Köhn added. “Saying this, we expect the demand for UV/LED solutions to continue to grow across all print applications going forward.”

Roland Schröder, product manager UV Europe at hubergroup, noted that hubergroup is seeing strong growth in UV sheetfed offset printing for packaging, although UV LED sheetfed offset is currently unable to meet the technical requirements.

“The reasons for this are the small number of available photoinitiators and the currently still narrow LED absorption spectrum,” Schröder said. “A broader application is therefore only possible to a limited extent. The market for UV commercial printing is already satisfied in Europe, and we are currently not expecting any growth in this segment.”

Jim Bishop, field product manager for Sun Chemical, reported that after large energy curing folding carton growth in 2020 as a result of COVID-19, the market began to stabilize in mid-2021.

“Depending on the end use application, market growth estimates are still ranging at around 2%,” Bishop noted. “Although shortages of certain grades of paper and the availability of energy curing raw materials have complicated things, it’s worth noting that conventional sheetfed press conversions to both UV and LED printing continue. Many new large format, high-speed UV sheetfed presses were installed in the North American market over the past year, and this trend is expected to continue as these new presses bring strong productivity gains.”

Alexander Blasek, global project manager UV flexo at hubergroup, observed that the fast finishing of products is becoming increasingly important, and the high durability of UV inks and varnishes is in great demand among manufacturers.

“Thus, we see a steady growth of UV flexo applications for the packaging and label market,” added Blasek.

Key Markets for Energy Curing

In speaking with leading UV ink suppliers, sheetfed offset folding carton is a hot market.

“The strongest growth is seen in the commercial printing market, which is changing from oil-based inks to UV inks along with the shift to UV LED,” said Takamizawa.

Schröder noted that at the moment, hubergroup is seeing the biggest growth in UV sheetfed offset printing for packaging.

“We are also experiencing a very strong increase in the UV flexo market – in Europe, for example, the growth rate is more than 5%, which is really remarkable compared to the rest of the UV ink market,” added Blasek. “Regarding the volume, however, UV offset is clearly in the lead. EB applications, which demand higher technical requirements then UV LED applications, are more dominant in the US market than in the EU.”

“Although energy curable technologies are growing on a global base in flexography, offset and rotary screen printing, the emerging markets see the highest growth rates compared to other regions,” Köhn observed.

Bishop said that Sun Chemical is seeing strong results in the narrow web tag and label segment, in addition to energy curable folding carton.

“It’s also worth keeping an eye on LED for commercial print applications, as it presents an excellent value proposition and is gaining traction,” Bishop said.

UV LED Expands

In recent years, UV LED has shown the greatest growth in the energy curing field. There are a few reasons for this, including concerns over mercury, as well as energy and cost savings.

“Mercury technology is still leading the way in UV sheetfed offset printing,” Schröder reported. “However, there have been major leaps in the UV LED technology in recent years. In Europe, further development will depend on the legislation. UV LED technology will surely experience a push if the EU decides to forbid mercury UV lamps.”

Derrick Hemmings, product manager, EC flexo and LED NA and ECP Canada at Sun Chemical, said that while interest in UV LED continues to increase, Sun Chemical is seeing converters purchase presses capable of using both mercury UV and LED curing.

“Energy savings in conversion to LED and utilization of heat sensitive filmic substrates continue to be a primary driver of this trend,” Hemmings noted. “LED lamps have been shown to provide 40%-50% energy savings to converters moving from mercury UV systems. Commercial offset and narrow web and label customers continue to lead the way in UV LED growth. However, sensitive packaging customers are showing an increase as ink suppliers continue to improve low migration ink offerings for UV flexo and offset.”

Takamizawa said that UV LED is growing, especially in the commercial printing market.

“We believe that the main reason for the growth of UV LEDs is due to their reduced energy consumption compared to conventional UV,” Takamizawa said. “Since reduction of energy consumption is a major environmental issue, the demand will continue to grow in the future.”

Blasek said that in flexo printing, hubergroup is seeing a trend towards UV LED applications, both in North America and Europe.

“In the EU, the reason for this is that the government wants to phase out the use of mercury in the coming years,” said Blasek. “In North America, advantages such as service life and electricity savings are driving the trend towards the LED technology. However, LED technology is in sum still more expensive than traditional UV technology. Consequently, UV drying with mercury vapor lamps is still most common. Within the next years, we expect a further trend towards LED technology.”

Köhn reported that UV LED is growing faster than traditional UV, not least because UV LED systems are becoming more and more cost-competitive, and growth and transition continue to increase globally.

“Nowadays, there is also a stronger momentum towards UV LED in markets like India, Southeast Asia and LATAM compared to the years before,” said Köhn. “In the US, converters primarily decide for UV LED to gain efficiency and productivity/performance while also benefitting from related energy savings.

“In the US, most UV LED applications are still non-low migration markets today, while in Europe, UV LED is strongly tied to food packaging applications due to its intrinsic advantages over traditional UV,” added Köhn. “In addition, more and more European converters are starting to use UV LED curing also for an increasing amount of new non-food packaging applications due to the technology’s impact on the overall sustainability. Most up-to-date UV LED curing systems consume approximately 50% less electrical energy than traditional UV.”

Energy Curing and Food Packaging

There are opportunities for energy curing in food packaging. Köhn pointed out that energy curable technologies meet food requirements.

“In particular, UV LED is a very good fit due to its controlled curing conditions,” said Köhn. “The demand for low migration UV and UV LED ink systems for food packaging applications is further increasing - not only in Europe, but also in other regions around the world. One driver for this development is that brand owners become more and more aware of this option and pull for it to benefit from all advantages this technology brings.”

Bishop noted that energy curable raw materials continue to face significant regulatory pressure related to safety and compliance.

“Many basic energy curable raw materials are undergoing chemical hazard re-classifications, which would significantly affect their usability,” said Bishop. “For example, inks and coatings that contain over 0.1% of the widely used and economical monomer TMPTA will soon be labeled as a category 2B carcinogen. Several photoinitiators that have been standard for years are under similar scrutiny.

“Many raw material suppliers and ink manufacturers are working in close harmony to identify alternative chemistries, especially as regulations evolve. Nimble suppliers will remain focused on developing longer-term solutions,” Bishop added.

“The safety of energy curable inks for food packaging applications is improving because formulations are being built with compliance in mind,” Bishop noted. “As testing, validation and migration test efforts intensify, the technology is becoming more precise.”

Takamizawa observed that there are various requirements for food packaging according to the laws of each country, industry and company standards, and complying with the requirements of each regulation can be said to meet the requirements for food packaging.

“However, the requirements are gradually changing as various chemical substances are used in inks, some of which, such as some UV photoinitiators and mineral oils, are undergoing safety reviews,” Takamizawa said. “We believe that by raising awareness to such safety information and making repeated improvements, not only for energy-curing types, we will better meet the requirements and conform to food packaging.”

“At hubergroup, we offer special Food Contact Material inks, varnishes, and fountain solution additives for UV offset printing on food packaging – for example, our NewV pack MGA, NewV tin, and Substifix MGA series,” Schröder said.

“These, of course, meet all requirements for food conform packaging printing. We see a great interest in these series, especially when a product is printed on substrates that cannot be printed in conventional offset, when the products are to have a particularly elegant appearance or when time pressure plays a major role.”

“We observe a great interest in UV LED inks from the food packaging industry,” Blasek said. “In the EU, which is a forerunner in terms of regulatory standards, Food Contact Material (FCM) applications dominate the UV flexo market.”

Energy Curable Technologies and Sustainability

The issue of sustainability is becoming paramount among brand owners and printers, and ink companies are well prepared for this trend.

“Energy curable technologies are considered sustainable and especially UV LED, which uses less energy to cure inks compared to traditional UV mercury systems,” said Köhn. “Besides, UV LED systems are safer since it is not reliant on mercury and doesn’t emit ozone during the curing process.

“There are many advantages to LED curing that not only converters, but also more and more brand owners, take notice of,” Köhn added. “Furthermore, energy curable systems are being developed and used for circular economy solutions such as deinking and floatable technologies to enhance packaging recyclability.”

Dr. Nikola Juhasz, technical director of sustainability, Sun Chemical, pointed out that energy curable technologies are becoming increasingly sustainable, including the omission of solvents and not applying high heat sources to dry. RadTech, the association for UV and EB technology, has been pushing sustainability for years.

“In addition, the advancement of LED curing technology is making energy curable increasingly sustainable,” Dr. Juhasz added. “From energy and heat management savings to improved efficiency over standard UV lamp technology, LED technology provides many benefits and is a key focus area moving forward.”

“Compared to other printing methods (gravure) in terms of performance such as quick-drying and compatibility with non-absorbent substrates, we believe that energy-curing technology is a sustainable technology because it is solvent-free and has less environmental impact and energy consumption in terms of drying systems,” Takamizawa said.

“In addition, we believe that the raw materials used in energy-curing technology will increasingly utilize renewable raw materials such as biomass materials, and therefore, we believe that energy-curing technology is a sustainable technology from the standpoint of resource reuse,” Takamizawa added.

“UV produced print products can be fed into the cycle of disposal and processing, just like those manufactured in conventional printing,” Schröder said. “Thus, they can be described as sustainable. However, there is still a great need for education and information among commercial printers and their end customers. At hubergroup, we offer deinkable UV ink series for sheet-fed and web offset printing as well as for continuous and flexo printing. All these series achieved very good results in deinking tests according to the INGEDE method 11.”

“Our inks and varnishes for flexo printing are not only certified for deinking on paper but can also be deinked on film,” Blasek said. “We validated this internally with tests according to the APR and EPBP 507 methods.”

Recyclable and Compostable

Dr. Juhasz said there are some UV and EB inks that are recyclable and compostable, and it’s an active area of interest for customers.

“Sun Chemical receives questions about the recyclability and compostability of such inks, and we’re investing heavily to further develop technology to meet consumer demands,” Dr. Juhasz said. “Sun Chemical’s SolarFlex CRCL inks are both washable and energy cured, as well as being compliant to APR protocols. In addition, Sun Chemical is actively evaluating and developing energy curable inks that pass the TÜV OK Compost standard.”

“UV printed materials have been said to be difficult to recycle, but the development of recycling methods and recyclable inks has been progressing, and sales of T&K TOKA’s deinkable UV inks are increasing,” Takamizawa said.

“However, although recycling itself has become physically possible, its effectiveness depends on the development of the social system,” Takamizawa added. “There are regional differences in the availability of recycling. The development of recycling systems will be necessary for recycling to become more widespread. Regarding compost, we recognize that development is progressing in various raw materials, as seen in the appearance of compostable film.”

Schröder noted that UV LED inks are not compostable, but they can be recycled.

“At hubergroup, we also offer a wide range of deinkable UV ink series, which enable high-quality recyclates,” Schröder added.

“The recyclability of UV flexo applications is one of our most important goals to achieve a circular economy and related sustainability goals,” Blasek said. “To this end, we are in intensive exchange with leading associations and manufacturers of packaging and labels.”

Köhn said that Siegwerk is committed to develop sustainable packaging solutions for all printing technologies including energy curing that either increase the recyclability of the packaging or reduce the overall material consumption.

“Inks constitute only a small portion of the entire packaging and are a complex chemical mixture,” added Köhn. “That’s why the actual ink development work rather focuses on the enablement of recycling and composting, ensuring that the ink does not hamper the recycling process, than on the direct recycling and composting of inks.”

In its report, “UV Cure Printing Inks Market Size and Forecast,” Verified Market Research puts the global UV curable ink market at US$1.83 billion in 2019, projected to reach US$3.57 billion by 2027, growing at a CAGR of 8.77 % from 2020 to 2027. Mordor Intelligence placed the market for UV cured printing inks at US$1.3 billion in 2021, with a CAGR of more than 4.5% through 2027 in its study, “UV Cured Printing Inks Market.”

Leading ink manufacturers confirm this growth. T&K Toka specializes in UV ink, and Akihiro Takamizawa, GM for its Overseas Ink Sales Division, sees further opportunities ahead, particularly for UV LED.

“In graphic arts, the growth has been driven by the switch from oil-based inks to UV inks in terms of quick-drying properties for improved work efficiency and compatibility with a wide range of substrates,” Takamizawa said. “In the future, technological growth is expected in the UV-LED field from the perspective of reducing energy consumption.”

Fabian Köhn, global head of narrow web product management for Siegwerk, said that energy curing remains a strong growth application within the graphic arts industry, further driving UV/EB ink market growth on a global basis, especially in narrow web and sheetfed printing for labels and packaging.

“The decline in 2020, due to the pandemic situation and related uncertainties, has been made up for in 2021,” Köhn added. “Saying this, we expect the demand for UV/LED solutions to continue to grow across all print applications going forward.”

Roland Schröder, product manager UV Europe at hubergroup, noted that hubergroup is seeing strong growth in UV sheetfed offset printing for packaging, although UV LED sheetfed offset is currently unable to meet the technical requirements.

“The reasons for this are the small number of available photoinitiators and the currently still narrow LED absorption spectrum,” Schröder said. “A broader application is therefore only possible to a limited extent. The market for UV commercial printing is already satisfied in Europe, and we are currently not expecting any growth in this segment.”

Jim Bishop, field product manager for Sun Chemical, reported that after large energy curing folding carton growth in 2020 as a result of COVID-19, the market began to stabilize in mid-2021.

“Depending on the end use application, market growth estimates are still ranging at around 2%,” Bishop noted. “Although shortages of certain grades of paper and the availability of energy curing raw materials have complicated things, it’s worth noting that conventional sheetfed press conversions to both UV and LED printing continue. Many new large format, high-speed UV sheetfed presses were installed in the North American market over the past year, and this trend is expected to continue as these new presses bring strong productivity gains.”

Alexander Blasek, global project manager UV flexo at hubergroup, observed that the fast finishing of products is becoming increasingly important, and the high durability of UV inks and varnishes is in great demand among manufacturers.

“Thus, we see a steady growth of UV flexo applications for the packaging and label market,” added Blasek.

Key Markets for Energy Curing

In speaking with leading UV ink suppliers, sheetfed offset folding carton is a hot market.

“The strongest growth is seen in the commercial printing market, which is changing from oil-based inks to UV inks along with the shift to UV LED,” said Takamizawa.

Schröder noted that at the moment, hubergroup is seeing the biggest growth in UV sheetfed offset printing for packaging.

“We are also experiencing a very strong increase in the UV flexo market – in Europe, for example, the growth rate is more than 5%, which is really remarkable compared to the rest of the UV ink market,” added Blasek. “Regarding the volume, however, UV offset is clearly in the lead. EB applications, which demand higher technical requirements then UV LED applications, are more dominant in the US market than in the EU.”

“Although energy curable technologies are growing on a global base in flexography, offset and rotary screen printing, the emerging markets see the highest growth rates compared to other regions,” Köhn observed.

Bishop said that Sun Chemical is seeing strong results in the narrow web tag and label segment, in addition to energy curable folding carton.

“It’s also worth keeping an eye on LED for commercial print applications, as it presents an excellent value proposition and is gaining traction,” Bishop said.

UV LED Expands

In recent years, UV LED has shown the greatest growth in the energy curing field. There are a few reasons for this, including concerns over mercury, as well as energy and cost savings.

“Mercury technology is still leading the way in UV sheetfed offset printing,” Schröder reported. “However, there have been major leaps in the UV LED technology in recent years. In Europe, further development will depend on the legislation. UV LED technology will surely experience a push if the EU decides to forbid mercury UV lamps.”

Derrick Hemmings, product manager, EC flexo and LED NA and ECP Canada at Sun Chemical, said that while interest in UV LED continues to increase, Sun Chemical is seeing converters purchase presses capable of using both mercury UV and LED curing.

“Energy savings in conversion to LED and utilization of heat sensitive filmic substrates continue to be a primary driver of this trend,” Hemmings noted. “LED lamps have been shown to provide 40%-50% energy savings to converters moving from mercury UV systems. Commercial offset and narrow web and label customers continue to lead the way in UV LED growth. However, sensitive packaging customers are showing an increase as ink suppliers continue to improve low migration ink offerings for UV flexo and offset.”

Takamizawa said that UV LED is growing, especially in the commercial printing market.

“We believe that the main reason for the growth of UV LEDs is due to their reduced energy consumption compared to conventional UV,” Takamizawa said. “Since reduction of energy consumption is a major environmental issue, the demand will continue to grow in the future.”

Blasek said that in flexo printing, hubergroup is seeing a trend towards UV LED applications, both in North America and Europe.

“In the EU, the reason for this is that the government wants to phase out the use of mercury in the coming years,” said Blasek. “In North America, advantages such as service life and electricity savings are driving the trend towards the LED technology. However, LED technology is in sum still more expensive than traditional UV technology. Consequently, UV drying with mercury vapor lamps is still most common. Within the next years, we expect a further trend towards LED technology.”

Köhn reported that UV LED is growing faster than traditional UV, not least because UV LED systems are becoming more and more cost-competitive, and growth and transition continue to increase globally.

“Nowadays, there is also a stronger momentum towards UV LED in markets like India, Southeast Asia and LATAM compared to the years before,” said Köhn. “In the US, converters primarily decide for UV LED to gain efficiency and productivity/performance while also benefitting from related energy savings.

“In the US, most UV LED applications are still non-low migration markets today, while in Europe, UV LED is strongly tied to food packaging applications due to its intrinsic advantages over traditional UV,” added Köhn. “In addition, more and more European converters are starting to use UV LED curing also for an increasing amount of new non-food packaging applications due to the technology’s impact on the overall sustainability. Most up-to-date UV LED curing systems consume approximately 50% less electrical energy than traditional UV.”

Energy Curing and Food Packaging

There are opportunities for energy curing in food packaging. Köhn pointed out that energy curable technologies meet food requirements.

“In particular, UV LED is a very good fit due to its controlled curing conditions,” said Köhn. “The demand for low migration UV and UV LED ink systems for food packaging applications is further increasing - not only in Europe, but also in other regions around the world. One driver for this development is that brand owners become more and more aware of this option and pull for it to benefit from all advantages this technology brings.”

Bishop noted that energy curable raw materials continue to face significant regulatory pressure related to safety and compliance.

“Many basic energy curable raw materials are undergoing chemical hazard re-classifications, which would significantly affect their usability,” said Bishop. “For example, inks and coatings that contain over 0.1% of the widely used and economical monomer TMPTA will soon be labeled as a category 2B carcinogen. Several photoinitiators that have been standard for years are under similar scrutiny.

“Many raw material suppliers and ink manufacturers are working in close harmony to identify alternative chemistries, especially as regulations evolve. Nimble suppliers will remain focused on developing longer-term solutions,” Bishop added.

“The safety of energy curable inks for food packaging applications is improving because formulations are being built with compliance in mind,” Bishop noted. “As testing, validation and migration test efforts intensify, the technology is becoming more precise.”

Takamizawa observed that there are various requirements for food packaging according to the laws of each country, industry and company standards, and complying with the requirements of each regulation can be said to meet the requirements for food packaging.

“However, the requirements are gradually changing as various chemical substances are used in inks, some of which, such as some UV photoinitiators and mineral oils, are undergoing safety reviews,” Takamizawa said. “We believe that by raising awareness to such safety information and making repeated improvements, not only for energy-curing types, we will better meet the requirements and conform to food packaging.”

“At hubergroup, we offer special Food Contact Material inks, varnishes, and fountain solution additives for UV offset printing on food packaging – for example, our NewV pack MGA, NewV tin, and Substifix MGA series,” Schröder said.

“These, of course, meet all requirements for food conform packaging printing. We see a great interest in these series, especially when a product is printed on substrates that cannot be printed in conventional offset, when the products are to have a particularly elegant appearance or when time pressure plays a major role.”

“We observe a great interest in UV LED inks from the food packaging industry,” Blasek said. “In the EU, which is a forerunner in terms of regulatory standards, Food Contact Material (FCM) applications dominate the UV flexo market.”

Energy Curable Technologies and Sustainability

The issue of sustainability is becoming paramount among brand owners and printers, and ink companies are well prepared for this trend.

“Energy curable technologies are considered sustainable and especially UV LED, which uses less energy to cure inks compared to traditional UV mercury systems,” said Köhn. “Besides, UV LED systems are safer since it is not reliant on mercury and doesn’t emit ozone during the curing process.

“There are many advantages to LED curing that not only converters, but also more and more brand owners, take notice of,” Köhn added. “Furthermore, energy curable systems are being developed and used for circular economy solutions such as deinking and floatable technologies to enhance packaging recyclability.”

Dr. Nikola Juhasz, technical director of sustainability, Sun Chemical, pointed out that energy curable technologies are becoming increasingly sustainable, including the omission of solvents and not applying high heat sources to dry. RadTech, the association for UV and EB technology, has been pushing sustainability for years.

“In addition, the advancement of LED curing technology is making energy curable increasingly sustainable,” Dr. Juhasz added. “From energy and heat management savings to improved efficiency over standard UV lamp technology, LED technology provides many benefits and is a key focus area moving forward.”

“Compared to other printing methods (gravure) in terms of performance such as quick-drying and compatibility with non-absorbent substrates, we believe that energy-curing technology is a sustainable technology because it is solvent-free and has less environmental impact and energy consumption in terms of drying systems,” Takamizawa said.

“In addition, we believe that the raw materials used in energy-curing technology will increasingly utilize renewable raw materials such as biomass materials, and therefore, we believe that energy-curing technology is a sustainable technology from the standpoint of resource reuse,” Takamizawa added.

“UV produced print products can be fed into the cycle of disposal and processing, just like those manufactured in conventional printing,” Schröder said. “Thus, they can be described as sustainable. However, there is still a great need for education and information among commercial printers and their end customers. At hubergroup, we offer deinkable UV ink series for sheet-fed and web offset printing as well as for continuous and flexo printing. All these series achieved very good results in deinking tests according to the INGEDE method 11.”

“Our inks and varnishes for flexo printing are not only certified for deinking on paper but can also be deinked on film,” Blasek said. “We validated this internally with tests according to the APR and EPBP 507 methods.”

Recyclable and Compostable

Dr. Juhasz said there are some UV and EB inks that are recyclable and compostable, and it’s an active area of interest for customers.

“Sun Chemical receives questions about the recyclability and compostability of such inks, and we’re investing heavily to further develop technology to meet consumer demands,” Dr. Juhasz said. “Sun Chemical’s SolarFlex CRCL inks are both washable and energy cured, as well as being compliant to APR protocols. In addition, Sun Chemical is actively evaluating and developing energy curable inks that pass the TÜV OK Compost standard.”

“UV printed materials have been said to be difficult to recycle, but the development of recycling methods and recyclable inks has been progressing, and sales of T&K TOKA’s deinkable UV inks are increasing,” Takamizawa said.

“However, although recycling itself has become physically possible, its effectiveness depends on the development of the social system,” Takamizawa added. “There are regional differences in the availability of recycling. The development of recycling systems will be necessary for recycling to become more widespread. Regarding compost, we recognize that development is progressing in various raw materials, as seen in the appearance of compostable film.”

Schröder noted that UV LED inks are not compostable, but they can be recycled.

“At hubergroup, we also offer a wide range of deinkable UV ink series, which enable high-quality recyclates,” Schröder added.

“The recyclability of UV flexo applications is one of our most important goals to achieve a circular economy and related sustainability goals,” Blasek said. “To this end, we are in intensive exchange with leading associations and manufacturers of packaging and labels.”

Köhn said that Siegwerk is committed to develop sustainable packaging solutions for all printing technologies including energy curing that either increase the recyclability of the packaging or reduce the overall material consumption.

“Inks constitute only a small portion of the entire packaging and are a complex chemical mixture,” added Köhn. “That’s why the actual ink development work rather focuses on the enablement of recycling and composting, ensuring that the ink does not hamper the recycling process, than on the direct recycling and composting of inks.”