So far, ink businesses have tended to avoid any major upheavals, mainly because outside of conventional publishing inks for newspapers, magazines and books, there are still growth segments, such as packaging and digital printing.

Meanwhile, the European Union (EU) faces another difficult year economically in 2013 despite a partial resolution of the crisis in confidence in the euro currency.

In 2012, GDP in the EU shrank by 0.3%, with a 0.6% decrease in the euro zone, according to the European Commission, the Brussels-based EU executive.

The commission was predicting in late 2012 slight growth in the 17-nation euro area this year, but because of worsening economic conditions, including a fall in output in Germany in the fourth quarter, it predicted in February that the euro zone would experience a further decline in 2013 of 0.3%, while the 27 nations of the EU would grow by a marginal 0.1%. However, forecasters are expecting to see signs of a general pick-up in Europe in the second half of this year.

Raw Material Costs

Ink producers in Europe have been hoping that with the European economies going through yet another downturn, they would at least benefit from an easing of the persistent rise in raw materials costs that has been affecting downstream sectors in the region over the last two to three years.

Price increases across a broad range of organic and inorganic chemicals have been leveling out since last summer, with decreases in some toward the end of the year.

With titanium dioxide, which has had capacity reductions in Europe since the 2008 financial crisis, there has been more of an equilibrium between the supply and demand of TiO2 leading to a softening of prices for the pigment.

Major players in the European TiO2 market, such as Huntsman, DuPont and Rockwood Holdings, owners of Sachtleben of Germany, announced declines in sales or profitability in the second half of last year.

In the fourth quarter, Rockwood reported that while sales from Sachtleben, which specializes in TiO2 for packaging inks, rose by 14%, EBITDA profits plunged by 90% as margins collapsed from 33% a year ago to 3%. It blamed the profits fall on lower selling prices, higher raw material costs and a decrease in production to reduce inventories.

Despite widespread decreases in TiO2 prices in late 2012 and early 2013, they are expected to go up again later in the year mainly because of stronger demand in decorative paints.

In its latest review of the raw materials market, Flint Group warns that although in some chemical sectors prices should continue to stabilize, they will be remaining at high levels compared to previous years.

With other raw materials, prices may fluctuate between decreases and increases, while in segments like carbon black and organic pigments they will continue to rise, particularly because of environmental controls on production of intermediates in China.

There is also a danger that the supply of some chemicals will recede in the face of falling demand, which has become a prevalent feature in inks, coatings and other formulator sectors in recent years.

“It is expected that many suppliers in the ink supply chain will see further shrinking of demand (so) we expect a number of suppliers to really struggle to survive,” noted the Flint Group report. “The large global chemical companies will decide to reduce output rather than go into the normal chemical pricing cycle. Given their domination, due to the last five years of consolidation, they will succeed.”

Move Toward Diversification

Pressure on margins from high raw material costs and sluggish demand is forcing ink producers in Europe to diversify and consolidate, although not to the same degree as other sectors of the region’s printing industry.

Sun Chemical, the European market leader in printing inks, has, in particular, been relatively busy in expanding in new markets and restructuring in its existing activities, particularly in hard-pressed segments like publishing inks.

In March last year, Sun Chemical announced it was merging its publishing inks business in southeastern Europe with that of Greek-based Druckfarben Hellas Group. The new operation has been split into five legal entities covering Bulgaria, Greece, Romania and Serbia, Bosnia/Herzegovina, Montenegro and Moldova for selling publication inks and coatings, as well as sheetfed, UV, screen graphics inks and consumables.

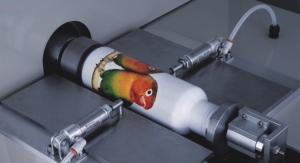

Sun Chemical has extended its range of inks for printing of glass with the introduction of UV organic inks that can be printed in full color or with a thermocolor or a frosted effect.

“This example of printed glass demonstrates the packaging quality and possibilities that brands can achieve through using UV organic inks,” said Robin McMillan, Sun Chemical’s European marketing manager industrial inks.

With its parent company DIC of Japan, Sun Chemical has also been extending its activities in printed electronics. At the recent European Photovoltaic Solar Energy conference and exhibition at Frankfurt, Sun Chemical and DIC showed a range of metallization pastes, as well as aluminum, silver and graphite pastes for insulators and resists.

Sun Chemical and its parent company have also combined to take over Benda-Lutz Werke GmbH, a leading Austrian-based manufacturer of metallic-effect products. The takeover means that Sun Chemical has a global metallic pigments operation with production facilities in China, Austria, Poland, Russia and the U.S.

It will also enable Sun Chemical to accelerate the broadening of the scope of its metallic pigments beyond the graphic arts market, as well as coatings and plastic sectors, into areas like printed electronics.

The Growth of Digital Printing

In the European printing sector, digital is currently prominent in the investment programs of ink companies. In the UK, for example, where a lot of development work is being done in new printing technologies, Fujifilm of Japan has just opened a new digital ink plant at Broadstairs while upgrading an R&D unit on the same site.

The plant, with annual capacity of 6,000 tons per year, will increase output of UV ink from the site by 56%, mainly to meet demand in the growing large format market. More than 80% of Fujifilm’s 340 employees at Broadstairs are now involved in digital ink manufacture or R&D.

“To stay at the forefront of digital ink technology with our range of (digital) inks, we need to work with state-of-the-art equipment and have the ability to increase production and packing volumes,” said Colin Boughton, operations director at Fujifilm Speciality Ink Systems, Broadstairs. “Our vision is to remain at the forefront of this technology and to re-invest every year in order to maintain that position.”

At Huntingdon in east England, Xaar, a global leader in inkjet printhead development and production, has invested £22 million ($34 million) in a manufacturing expansion which has increased the annual capacity for production of one of its latest printheads ninefold to 45,000 units. The printhead was originally developed for the ceramic printing market, but is due to be launched in the graphics arts market this year.

“Our resource at Huntingdon is now a showcase of British manufacturing that includes three Class 1000 clean rooms and some highly specialized and unique equipment,” said Phil Lawler, chairman of Xaar, which develops inks for its printheads in partnership with a number of ink producers.

Xaar has been raising its expenditure on R&D by maintaining it at an 8% share of revenues, which have been going up at double-digit rates.

Advances in digital technologies are currently achieving the big breakthroughs in research into new inks and printing processes.

The main point of discussion at last year’s drupa, the world’s leading printing exhibition in Dusseldorf, Germany, was a digital printing technology with a nano pigment ink developed by Israel’s Landa Corporation. The company is headed by Benny Landa, a pioneer in digital printing who developed and created the Indigo technology and business, which was taken over by Hewlett Packard 10 years.

Landa Corporation’s research achievement – called Nanographic – is based on nanotechnologies, which both considerably raise the quality of color print and substantially lower its costs.

The ink comprises billions of microscopic water-based droplets with pigment particles only tens of nanometers in size. The water evaporates as the droplets land on a heated blanket conveyor belt to form an ultra-thin dry polymeric film of 500 nanometers thickness, less that half of that of offset images.

The technology, which still has to be improved before it can be fully commercialized, has the potential to accelerate the growth of digital printing. It could also radically change the structure of the printing industry because of its ability to combine strong color concentration with low pigment loading making printing a far more economical process.

Landa Corporation’s strategy appears to be to license out its process technologies to press equipment manufacturers while using the inks and other consumables like blankets as its major source of revenue. The Israeli company is typical of the new generation of developers of new printing technologies in that the aim is not to restrict the application of the Nanographic knowledge just to printing. It is planning to use the nanoparticle innovation as a source of alternative energy through the conversion of sun light into electricity.

Some of the established players in digital printing technologies are trying to avoid becoming over-dependent on revenues from the manufacture of printing presses, equipment and inks, toners and other consumables.

Over the past year, some of them have been increasing their efforts to diversify into other areas of communication technology and, particularly, into services.

In the fourth quarter of last year, services accounted for 52% of Xerox’s revenues after the company had concentrated during 2012 on expanding its services businesses. It has been introducing software systems embedded in multifunctional printers which are as a result able to be used as hubs to scan and upload documents to cloud repositories and to send business-critical documents directly to workflow processes.

Canon Europe launched a bid in September to take over I.R.I.S. Group, a Belgian-based software company specializing in optical text recognition (OCR) as part of Canon’s objective of expanding into business and consultancy services.

“We will be working closely with I.R.I.S. to deliver more advanced solutions and services and greater customer value,” said Rokus van Iperen, Canon Europe’s president and chief executive.

Konica Minolta agreed in November to acquire Charterhouse PM, a UK-based specialist in document management for marketing planning and sales promotion, which is in line with Konica Minolta’s aim to make itself more competitive in the European production print market.

The trend among digital printing companies towards more diversified and more services-oriented businesses has created different marketing policies less focused on demonstrating technological prowess and more on forging direct ties with customers.

This promotional change looks likely to affect the range of exhibitors at next year’s IPEX, the second biggest international printing exhibition after drupa. It is usually held in Birmingham, England, but next year it is moving to London. Already Xerox and HP, previously two of IPEX’s leading exhibitors, have pulled out of the event.

Xerox said that with the “marketing landscape” changing so fast in the graphics communications industry, it has been re-evaluating how best to reach existing and potential customers. “We listened to what our customers were saying around the globe,” explained Jeff Jacobson, president of Xerox global communications. “They wanted to connect with us in different ways – with regional and personal engagements.”

HP said in a statement after announcing its withdrawal from IPEX that “we are shifting our marketing and sales focus to more local and application-specific events, as well as to customer business-development programs.”

Press and Paper Production

The scale of the contraction of the print media is underlined by the amount of pulp and paper making capacity that has been closed down in the region to try to bring supply more in line with demand.

Stora Enso, one of Europe’s largest paper producers, announced in February that it would be shutting permanently 475,000 tons of annual newsprint capacity after demand for newsprint and coated magazine paper dropped by 9% in Europe in 2012. With decreases in paper demand average 5% per year since 2007, this indicated a deepening slump in paper consumption in the two largest media-driven segments, according to the company.

“This means we must accelerate capacity reduction plans to avoid running cash zero or even negative businesses,” said Jouko Karvinen, Stora Enso’s chief executive.

UPM, another of Europe’s major paper makers, revealed at the beginning of this year plans to close 580,000 tons of graphic paper capacity in Europe. In addition to closures already announced, the company will be shutting down a total of 850,000 tons of graphic capacity paper capacity.

“In the overcapacity situation we need to adjust our capacity to the level of profitable demand,” said Jyrki Ovaska, president of the UPM Paper Business Group.

Norwegian-based Norske Skog reduced capacity over the past year by around 18% to 3.7 million tons, mainly newsprint and magazine paper. This helped to maintain capacity utilization at nearly 90% and to achieve a 36-fold increase in operating profit.

Cutbacks in production by press equipment manufacturers are also improving their profitability and increasing utilization rates by slimming down and concentrating production capacity.

Koenig & Bauer AG (KBA), the second largest printing press maker behind Heidelberg and the leader in newspaper presses, disclosed late last year that it would be transferring web-press production at Trennfield, Germany, to its main site 16 miles away at Wurzburg.

“From any economic point of view, keeping only two partly utilized plants open does not make sense,” said Claus Botza-Schuenemann, KBA chief executive. “Our web business can only look positively into the future when all employees, space and equipment available are fully utilized.”

The KBA group, which has a 40% global market share for newspaper presses, is the only major press manufacturer whose financial results have remained in the black since 2009. This has been mainly because of its presence in non-media sectors such as packaging and security printing.

During its current financial year to the end of March, Heidelberg has been increasing sales and cash flow after boosting its orders at last year’s drupa.

In the third quarter ending on Dec. 31, 2012, sales went up 9% while operating profit excluding special items rose 11 fold to €25 million ($33 million). However over the nine months in which sales rose by 5% to €1.9 billion, operating loss was 68% higher at €32 million.

Like other printing press makers, the company is attempting to diversify its activities to raise profitability. One area of expansion has been the distribution of inks and other consumables. In October it took over the Swiss distributor OFS Group so that after being merged with Heidelberg’s existing distribution operation in Switzerland, it has become a leading dealer in consumables in the graphics industry.

“Just like our successful customers, we must be dynamic in focusing our portfolio on profitable segments,” said Gerold Linzbach, Heidelberg’s chief executive.

However, in areas like food packaging, there is likely to be a trend away from the supplying of inks and consumables through distributors to more direct links with producers.

A food scare across Europe in January and February this year over horse meat being found in a relatively high number of packages labeled as beef products is forcing food producers and retailers to become much stricter about the safety and contents standards of their brands.

Brand owners, including supermarket chains with private brands, are now beginning to monitor even more closely the quality of food packaging, including the long-standing issue of food migration. The horse meat scandal has raised public anxiety about other possible sources of food contamination, such as chemicals migrating from the packaging material into food.

In response to public concerns, food processors and retailers are demanding more direct contact between the key points of the supply chain, particularly between ink and packaging producers. This year, tighter regulations will provide an even bigger impetus for closer controls on packaging supply chains.

The German government is due this year to introduce a Consumer Goods Ordinance covering the quality of food packaging inks, including limits on migration. The Ordinance is likely to become a new standard not only in the European Union but across Europe.

“It will certainly lead to an official enforcement of migration limits – .g. for photoinitiators and binders – n the field of UV printing, which should be taken extremely seriously,” said Sandro Leuenberger, senior manager global HSE at Siegwerk. “The new ordinance is expected to be published in the course of 2013 and will provide a legal basis for ordering product recalls and material impoundments.”

Tougher regulations on food migration will be just be one of a number of challenges in HSE facing ink producers in Europe this year.

Compliance with REACH – the EU legislation on the registration, evaluation and authorization of chemicals – will become more difficult as it is extended to the content of safety data sheets (SDSs). Also the European Commission is stepping up its efforts to enlarge the official EU list of substances of very high concern (SVHC), which ink producers and other formulators will only be able to use if they cannot find safer alternatives.

European Editor Sean Milmo is an Essex, UK-based writer specializing in coverage of the chemical industry.