As the U.S. economy slumped in 2001, the ink industry suffered through a difficult year. As is the case whenever there is a prolonged economic downturn, companies look for ways to reduce costs.

As companies look to cut their budgets, new capital expenditures often are among the first items that are analyzed closely to see how necessary the improvements are, and whether purchases can be delayed.

Essentially, that was the situation milling manufacturers faced in 2001, as their customers in ink and other industries looked long and hard at funding capital improvements. While mill manufacturers say that the early returns from 2002 look promising, only time will tell if the economy is headed toward recovery. Meanwhile, mill manufacturers are continuing to develop new systems that increase productivity and ease of use.

Economic Impact on Capital Equipment

Most mill manufacturers believe that the U.S. economy’s weakness impacted equipment purchases.“There has been an economic impact on our day-to-day business, and I think you will find this true for most capital equipment suppliers,” said George J. Murphy, national sales manager, Hockmeyer Equipment Corp. “We have been supplying the chemical industry for more than 60 years and have seen this before. We all need to make adjustments in our daily business to get through it. We also see this as an opportunity to take a look at our business and the products we offer and fine-tune our focus, and we will come out the other side a better and stronger company.”

“Major capital expansions were down in the ink industry in 2002,” said Dave Peterson, vice president of Eiger Machinery. “The level of inquiries was very good last year, but many projects were put on hold, especially after Sept. 11. Some projects have been put back into the budget for 2002.”

“The economy has been a mixed bag, depending upon your focus,” said Leo McWilliams, technical consultant for CB Mills. “The companies working on emerging technologies are going like gangbusters, with the biggest growth in the ink jet and textile markets.”

“For Netzsch, we have not seen a reduction in interest in machinery,” said Harry Way, manager of R&D, grinding and dispersion division at Netzsch. “It’s quite the contrary. Mainly, we see that when there is a slowdown in production it means an opportunity for our customers to upgrade their existing equipment or replace outdated machinery. What we have seen from the larger producers is consolidation in their manufacturing sites with expansion of those sites. This means new, larger machines and control systems.”

Milling companies report that their prospects appear to be improving during the first quarter of 2002. In some cases, retrofitting is an option.

“In the ink industry, we have seen more specific and steady growth through 2001 and in this first quarter,” Mr. Murphy said. “We credit this to the acceptance and success of the Hockmeyer Immersion Mill, the HM and HCP series.”

“Business has been pretty consistent,” said Stewart Rissley, eastern regional sales manager for Morehouse-Cowles, which offers mills, mixers, dispersers and let-down tanks. “We have quite a few leads from companies looking to increase productivity over three-roll mills, and our Zinger horizontal mill has been successful because of its high consistent energy.”

“Draiswerke has had a successful year for supplying mills into the ink market despite the obvious economic recession,” said Jeff Pawar, sales engineer at Draiswerke. “A large part of our success is due to the recent technological advances in our high performance media mills that have allowed our customers to achieve higher quality products.”

“It’s been a mild recession, and we’re seeing signs of activity as inquiries are picking up,” said John Sneeringer, technical director at Premier Mill. “Our testing lab is very busy now. Capital equipment is still under scrutiny, but companies are doing research toward capital improvements. Meanwhile, we’re helping our customers retrofit some of our recent design changes onto older machines, which significantly helps increase productivity.”

“Netzsch is experiencing more new purchases versus retrofitting of equipment, especially in the constantly growing ink industry,” Mr. Way said. “Considering the cost to retrofit both controls and changing to newer mill technology, the cost is about the same. In other words, why retrofit older mill technology with new control systems when the real productivity boost comes from improved milling technology, data acquisition and automation?

“However, in the past five years, Netzsch recognizes that in some cases sales for refurbished or replacement machines is also significantly increasing,” Mr. Way continued. “To meet all of our customers’ needs and demands, Netzsch takes a great interest in retrofitting used or outdated machinery to the same specifications as new equipment. Our customers know that we offer quality rebuilt machines as an interesting option for smaller companies or start-up ventures.”

Changes in Mills Over the Years

Craig Tompkins, Sun Chemical Ink’s (GPI) vice president of manufacturing and engineering, has been with Sun since 1979. Over the years, he has seen the technology and the use of mills change dramatically, particularly on the liquid ink side.“If you go back 20 years, paste and liquid ink mills were pretty similar,” Mr. Tompkins said. “Advancements have been made, particularly on the liquid side, with recirculating mills and theory about particle size. The level of dispersion and throughput are so much greater today. Back then, ink making was an art, and the operator defined the parameters. Today, there’s a lot more science involved in the milling and grinding process.”

“There are better controls with some of the mills we’re using,” said Dr. Suresh Mani, technical director, liquid inks for Flint Ink. “There are better horizontal mills, which is an improvement from the old days when they used vertical mills for fluid inks. As a result, gloss and strength properties have improved.”

“If you go back 20 years, I don’t think we’ve seen quite the improvements in mills on the paste ink side,” said Diane Parisi, technical director, paste ink for Flint Ink.

Mills are only as good as the raw materials and the operators who run the machines. Decades ago, milling was done more by intuition rather than by hard numbers. As the need for consistency has become more prevalent, new technologies have been developed.

“We certainly hope ink making is becoming more of a science,” Ms. Parisi said. “Quality control is done up front and operators are trained to a much higher degree. Still, it doesn’t matter how good the mill is if you don’t add the right raw materials.”

Deciding what mill to buy isn’t simply a matter of picking out a piece of machinery. The new mill has to fit within the entire manufacturing operation.

“We look at it as a piece of a system,” Mr. Tompkins said. “We don’t evaluate anything on a straight mill basis. We evaluate the entire process to see what gives the best quality and throughput, and the degree of automation has to be factored in to make sure the mill works with the rest of the process.”

|

||||||

Trends in Mills, Media

Improving productivity and repeatability are always priorities for ink manufacturers, and milling companies are working to achieve those goals.“Customers are looking for greater productivity,” said Mr. Sneeringer. “Getting the most quality per pound per hour from the smallest possible machine is especially important during recessions."

“Ink companies are looking for mills that have repeatability and reliability and easy operation for product processing with supplying a quality product with good color development and tight particle size distributions depending on the end use,” said Mr. Murphy.

The use of ceramic media has grown, particularly in water-based applications. “A lot of water-based applications use ceramic media, as the use of ceramic in water prevents corrosion and lasts longer,” Dr. Mani said.

Still, ceramic media has its own problems, as breakage does occur over time. “You need to be proactive on the life of the media you are using,” said Tim Kissell, Flint Ink’s director of corporate engineering. “There’s decay as the media is consumed.”

“People are looking to get as much as they can from a smaller mill,” Mr. Sneeringer said. “People are starting to use the new higher quality, higher density ceramic media, which can have a major impact on productivity.”

“Many ink companies are looking for technology increases that will make milling easier,” Mr. Peterson said. “There has been a push toward smaller media, which offers more contact points. Ceramic media are becoming denser, which transfers the mill’s energy to the product better, and denser beads have the added advantage of not degrading as quickly.”

Diagnostics

Better diagnostics is an area that ink makers would like to see improved. “We need to be able to measure dispersion quality,” said Anand Sharangpani, senior processing engineer for Flint Ink. “If you control all the milling conditions and raw materials, you narrow the particle range.”“We need a way to predict or measure the efficiency of the mill,” said Mr. Kissell.

“What we need to do is build quality into our product by default, rather than by inspection later,” said Duane Ness, director of manufacturing services for Flint Ink.

Milling companies are working to fill those needs with systems that can measure a variety of production aspects.

“There’s a lot of interest in linking computers to mills and mixers to monitor power usage,” Mr. Peterson said. “Our mills monitor temperature, pressure, amperage, product flow, cooling water temperature and flow.”

“We are adding the Premier Navigator, a process monitoring and control package, to a high percentage of our customers’ mills,” Mr. Sneeringer said. “It is tied into an on-board computer that can manage the mill’s functions and provide data recording, collection and output. All of the mill’s functions can be monitored, which helps increase productivity and eliminate operator error.”

“Better diagnostics are of interest, specifically with a lot of companies going for ISO certification,” Mr. Murphy said. “We offer our HM and HAP Immersion Mills with our APCII control system. The PLC-based Auto Process II control center enables the operator to run the machine on autopilot or manual control. APCII allows process temperature and grind time limits to be set on a case-by-case basis. In the automatic mode, it monitors batch temperature and regulates the mill to control heat. A warning horn sounds if product temperature exceeds the operators lower limit set point. If left unanswered, the control will shut down the mill at the upper limit set point.”

“We see more customers taking advantage of the process controls available for safety and automation,” said Mr. Way. “We see more customers installing instrumentation that monitors process conditions like temperature, pressure and power draw of a bead mill, and feeding this information to a PLC allows constant adjustments to the processing condition like flow rate and rotor speed to maintain safe continuous operation at the maximum efficiency of the machine. The costs and reliability of these systems have improved over the past few years. Netzsch engineering has made this technology available as a very low cost alternative on all of their beads mills with our Voyager control system.”

Better diagnostics do come at a cost. “Data acquisition is a standard feature,” said Mr. Way. “Automation becomes more expensive because you need the programs and hardware to automatically monitor grinding energy, temperature and product flow. It’s a few thousand on the price of the mill, but the benefits outweigh the costs.”

Ultimately, ink and milling companies will need to work together to develop systems that include essential diagnostics.

“We look at the complete system, including premixing and dispersion areas,” said Dr. Mani. “We’re always looking for easier cleaning and diagnostics inside the mill. Ultimately, we need a systems approach and better partnerships.”

New Products for 2002

Mill manufacturers are working hard to develop new millsAs part of its systems approach, Netzsch is planning on introducing a new inline mixer this spring. Another recent development, its Inka NKM Mill, is designed for UV offset and other applications.

“The Inka Mill optimizes cooling of the mill, because UV inks need to be kept below 120°F, and the agitation system delivers a maximum bead flow pattern to prevent hydraulic packing,” Mr. Way said. “We have recently introduced the Inka mill, cooled rotor for our proven Zeta Disc Milling system, Turbomill for certain inks, and a new screen system for using < 200 micron beads for ink jet manufacturing. Netzsch is also preparing to introduce this spring an all new Inline Mixer. This machine will provide ideal dispersion results once fine dispersed powders are wetted in the new Inline Mixer.”

Eiger Machinery has developed a modified version of its Alpha horizontal mill, which is ideal for fluid inks and can be modified for paste inks.

“We have produced a new version of our Alpha production horizontal mill, which handles the smaller, denser media and provides the cooling necessary to do efficient milling,” Mr. Peterson said. “The Alpha mill also has new media separator technology to handle low or high viscosity products with minimum pressure.”

Draiswerke has designed a pair of new mills, the Advantis and Cosmo Perl Mills.

“The Advantis and the Cosmo Perl Mills have significantly improved cooling capabilities and grinding efficiencies,” said Mr. Pawar. “In the Cosmo, the grinding chamber internal pins have been removed, creating a tight shear grinding zone with the highest energy to volume ratio (14 KW/L) for maximum grinding capability. In the Advantis, the inner stator has been constructed from silicon carbide as opposed to stainless steel. Because the silicon carbide has much higher heat transfer coefficient, ink manufacturers will have better control of their process temperature. The increased flow rate capability promotes faster grinding times, anywhere from 20 to 30 percent.”

Ink jet is also growing in numerous applications. CB Mills is working to develop mills that will achieve the particle size reduction needed for printheads. CB Mills has developed its new ECM Poly high-efficiency mill primarily for use in fluid and ink jet inks, a high-production 8-liter mill that has a unique accelerator and screen design, and is designed to perform better than conventional 20-liter mills.

“The ECM Poly high-efficiency mill is unique in that it’s not a disk or pin mill,” said Dave Pagor, sales manager for CB Mills. “The advantage is that the mill accelerates the media much more efficiently, and it is designed to deliver maximum specific energy input, reducing milling time.”

Premier Mill’s QMAX series emphasizes increased productivity.

“Premier Mill’s QMAX series is a new line of mills that increases the maximum shear level in the grinding chamber, and is designed for high flow recirculation,” Mr. Sneeringer said. “As grinding requirements become finer, many people are looking for higher flow recirculation, which leads to very fine particle sizes. The QMAX series features smaller chambers with more horsepower and increased cooling capacity, which ultimately increases productivity per unit of volume. We can do more with a 10-liter chamber now than we used to be able to do with a 35- or 40-liter chamber a few years ago.”

|

||||||

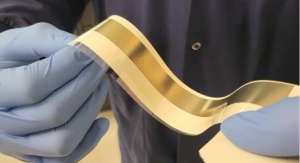

Morehouse-Cowles’ Zinger utilizes a rotor configuration.

“The Zinger mill has a unique configuration,” Mr. Rissley said. “Conventional disk mills use a disk that relies on viscosity of the product to accelerate the media, which is inefficient and creates heat, which affects the media’s wear. The Zinger has a rotor configuration that mechanically moves the product. As a result, there’s less wear on the media and the mill‘s internal parts.”

Hockmeyer’s Immersion Mill is designed for efficiency. “The Hockmeyer Immersion Mill is the most efficient and versatile mill offered on the market today,” Mr. Murphy said. “The Hockmeyer Immersion Mill is available to operate in batch sizes from 750 milliliters to 5300 liters. Its proven design will outperform all other media milling systems – horizontal, vertical or basket type – by a range of 30 percent to 300 percent. The basic machine consists of a highly polished, water-cooled, submersible basket with side and bottom screens and upper and lower draft tubes. Within the basket is a rotating hub with pegs and a removable (HEC Patent) counter-peg assembly. Top and bottom pumping impellers work together to enhance the flow of the dispersion through the bead field in the basket.

“With the Hockmeyer Immersion Mill, rapid mixing and milling of raw materials are completed simultaneously in one tank engaged for the entire cycle,” Mr. Murphy said. “It may lead to a reduction of raw material costs by an average of 5 percent, and has highly efficient use of small quantities of media as small as 0.25 mm and as large as 2 mm.”

Conclusion

Gone are the days when choosing mills was a matter of simply picking a machine for an operator to run. Now, miills are required to achieve much greater accuracy and productivity, and are part of the entire manufacturing process.For mill manufacturers and their customers in the ink industry, it has become ever more important to work together to create systems that will meet these increasing needs. In essence, milling and ink manufacturers must develop partnerships to create equipment that will meet present and future needs, and thus ensure success in the coming years.